|

i'm your huckleberry. that's just my game.

|

Posted: 5/18/2024 8:48:20 AM EDT

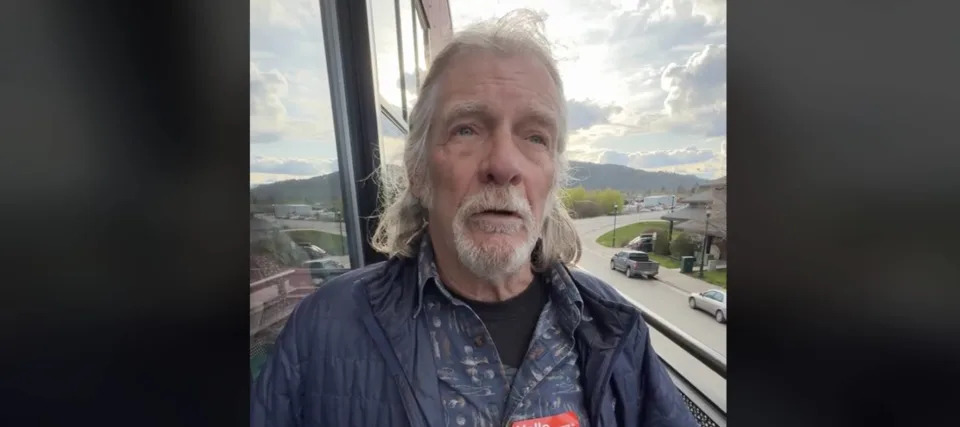

A senior from Montana has delivered a viral speech about the sorry state of property taxes in the Treasure State. "I'm on Social Security, I'm 68-years-old and working just to pay my taxes," says Kurt, in a clip shared on TikTok by Ryan Busse, who is running to be the next governor of Montana. Kurt claims that over the last couple of years, his annual property taxes have soared from $895 to almost $8,000 an increase of around 790% which he says is like paying almost "$700 a month rent to the state to live in our own house." The state has an Elderly Homeowner/Renter Tax Credit, and the maximum credit is $1,150. "There needs to be a moratorium on what we have to pay," he says, adding that he's had to continue working into what should be his retirement golden years to cover his mounting property costs. "I'm stubborn enough [that] I don't want to dig into my bank account to pay them." Kurt is one of thousands of Montana homeowners suffering sticker shock over recent property tax hikes. He says: "We just can't take this anymore. This was a great place and it still is, but the people that made it great can't afford to live here anymore."  View Quote moar |

|

I have a dream that my four children will one day live in a nation where they will not be judged by the colour of their skin but by the content of their shitpoast. - sierra-def

membership courtesy of TMS. thanks buddy! |

|

Taxation is theft.

|

|

|

|

|

As someone who fought the local school bond tax hike..I feel this man’s issues.

|

|

|

connoisseur of fine Soviet and European armored vehicles

https://t.me/arfcom_ukebros Let's go Brandon CINCAFUGD |

|

Why have the property taxes gone up that much?

|

|

|

|

|

Is this another case of Montana just sat on low rates forever or no?

I'm in SW Ohio and I pay $11k for 0.4 acres.

|

|

|

|

|

...and that is how they intend to take your land and give it to others

gotta have that "Iconic" architecture at the elementary school that will stop an F5 tornado gotta have those new automatic disconnects on all the fire trucks down at the local rural volly |

|

|

Don't ask me how I did it. I just did it, it was hard...

|

|

At what age should you stop paying property tax?

Let them take the tax out of the sale price after I’m dead. |

|

|

[NO TEXT]

|

|

He's not wrong

Mine went up another 33% this year Elder abuse |

|

|

|

|

|

|

"According to Argonne National Laboratory, it takes 100 pounds of battery in an EV to go a distance achieved by only one pound of gasoline in an ICE vehicle"

|

|

I’m not from Montana, but have known a few from there. I’ve never heard the term Montucky except in JL threads here. Is that a common term for Montana?

|

|

|

|

|

|

|

Same as ohio, property taxes are based on home value.

1% * $100k home =$1k/yr in taxes Loan rates + Californian = it's a $500k house with $5k/yr in taxes. |

|

|

|

|

i'm your huckleberry. that's just my game.

|

Originally Posted By Ecarl4100: I'm not from Montana, but have known a few from there. I've never heard the term Montucky except in JL threads here. Is that a common term for Montana? View Quote montucky |

|

I have a dream that my four children will one day live in a nation where they will not be judged by the colour of their skin but by the content of their shitpoast. - sierra-def

membership courtesy of TMS. thanks buddy! |

|

Just wait until some California transplant tells him how they levied property tax on senior citizens back home.

|

|

|

|

|

As Texas ridiculous property taxes piss me off every year, I feel his pain. It's BS.

I found out tax appraisal this year and won. They raised the value of my house, arbitrarily, $40,000. Yes $40,000. I was the highest increase in our neighborhood. Much bigger houses went down or increased a couple thousand. The house across the street went down. They had zero explanation. But dropped the valuation back to a reasonable level. |

|

|

|

|

Bidnesses are going under left and right (smaller local biz) and so the tax base in many counties has dropped.

Free transitions butcherings don't pay for themselves. And yet, people think everything is fine. |

|

|

|

|

Most of this is driven by the Cult of Public "Education."

Teacher and administrative salaries and benefits, massive school construction projects, etc., that no one dares to question because it's "for the children," when it is actually for all the adults attaching themselves to the government teat. No one over 60 should have to pay a "school tax" regardless of the value of their property. And people who are sending their children to private schools should be able to back their tuition out of their property tax to some extent. |

|

|

KEEP CALM and let ME Carry On.

|

|

Originally Posted By fadedsun: As someone who fought the local school bond tax hike..I feel this man’s issues. View Quote Last Tuesday we had our primary, and ther were 2 bond issues. One to continue a property tax for fire, one for EMS. I voted against both, but both won by a 4 to 1 margin. WTF? |

|

|

A true Texan would never leave his friends behind!

|

|

Well if he has time to complain and make videos, clearly he has time to work more and pay his fair share to the king. Double his taxes.

(That was sarcasm a la Robin Hood for those of you that didn’t get it) |

|

|

"The ARFCOM Survival Forum -- 90% LESS tinfoil than any other survival forum on the net." -- TriggerHappy83

|

|

If you've lived & worked in a state and paid taxes for X number of years, let's say over 10 years, your property taxes should cease if you're 65 or older.

Gov't plans to tax you into homelessness to make room for the tax revenue producer. If you aren't a producer, they prefer that you either leave or die. That's an actual fact, they see you as a financial liability otherwise. |

|

|

How come every time there is a shooting, they want to take away the guns from the people who didn't do it?

|

|

Ludwig Boltzmann, who spent much of his life studying statistical mechanics, died in 1906, by his own hand, Paul Bhranfest, carrying on the work, died similarly in 1933, Now it is our turn to study statistical mechanics...

|

|

|

|

In FL it’s basically capped at 3% per year.

|

|

|

|

|

Ryan Busse is a cunt.

ETA: taxation is theft and the article is not wrong. However I have a visceral hate for the traitorous liberal cunt Ryan Busse. |

|

|

|

|

Good ol property taxes, aka renting from the government.

|

|

|

|

|

Originally Posted By colklink: Last Tuesday we had our primary, and ther were 2 bond issues. One to continue a property tax for fire, one for EMS. I voted against both, but both won by a 4 to 1 margin. WTF? View Quote People like to keep their house from burning? Not sure about your state, but in Ohio the fire, EMS, library, and township property taxes are pretty stinking low. Maybe 5-10% of the tax we pay. It’s the damn schools and their constant demand for new buildings and threats to cut sports that make up 90%+ of our property taxes. And each year the graduation rates go down despite more cash. Our taxes have doubled over the 18 years we have lived in our current house. All due to school levies. Somehow the library has managed to live on the same $80 per year they have been getting from us. |

|

|

"The ARFCOM Survival Forum -- 90% LESS tinfoil than any other survival forum on the net." -- TriggerHappy83

|

|

Property taxes on privates residences are tyrannical and disrespectful to the people that work to pay for their home.

For now it would seem the people are pursuing option 1: Talk it out. Use of Option 2 is probably going to be the future choice. |

|

|

|

|

|

|

Ryan Busse is a gun grabbing faggot.

|

|

|

|

|

A Grendel's Love is different from a 5.56's Love

|

The TEA party needs to come back.

|

|

Leave me alone. I’m a libertarian. CW vet x7, give away a kidney to a loved one if they need it.

|

|

Originally Posted By Malitov: Property taxes on privates residences are tyrannical and disrespectful to the people that work to pay for their home. For now it would seem the people are pursuing option 1: Talk it out. Use of Option 2 is probably going to be the future choice. View Quote Option 2 will never happen. Things will just get worse, but “conservatives” will just post spicier memes about the tree of liberty and the 2A. |

|

|

|

|

Originally Posted By WWolfe: You midwesterners really get screwed on property taxes. What on earth does OH do with all that money? View Quote In Ohio the state gets none of it. Most goes to schools and a small portion goes to local government. It’s disgusting how much schools take and don’t appreciate it. |

|

|

"The ARFCOM Survival Forum -- 90% LESS tinfoil than any other survival forum on the net." -- TriggerHappy83

|

|

i'm your huckleberry. that's just my game.

|

|

|

I have a dream that my four children will one day live in a nation where they will not be judged by the colour of their skin but by the content of their shitpoast. - sierra-def

membership courtesy of TMS. thanks buddy! |

|

I always say nobody owns their home. If you think you do, just miss a couple property tax payments.

|

|

|

|

|

i'm your huckleberry. that's just my game.

|

|

|

I have a dream that my four children will one day live in a nation where they will not be judged by the colour of their skin but by the content of their shitpoast. - sierra-def

membership courtesy of TMS. thanks buddy! |

|

Tattoo'd and Voted #1 in blind taste tests.

|

Property taxes are becoming unattainable for many.

One of the many reasons why we're leaving. |

|

(_@___]]~~ It is better to smoke here, than here after.

If I wanted youtube, I'd go to youtube. Dont be lazy in GD. http://www.marinebattleherk.com |

|

i'm your huckleberry. that's just my game.

|

|

|

I have a dream that my four children will one day live in a nation where they will not be judged by the colour of their skin but by the content of their shitpoast. - sierra-def

membership courtesy of TMS. thanks buddy! |

|

In America, the village idiots have organized.

|

|

Originally Posted By daveo: Feed the pig.. In Illinois, it’s because of the school pensions. 75 percent of my taxes go to the school district. View Quote Indiana I think 2/3 goes to the schools. Not sure how it’s distributed from there. Originally Posted By Shockergd: Same as ohio, property taxes are based on home value. 1% * $100k home =$1k/yr in taxes Loan rates + Californian = it's a $500k house with $5k/yr in taxes. View Quote Indiana rates are about the same. We sold our nice house in part because the property assessment went from 500k to almost a million over the 11 years that we owned it. That’s going to be rough $1,000 a month in property tax alone. Along with insurance and utilities skyrocketing it didn’t seem worth it to stay any longer even if we paid it off. It was almost $3000 a month property tax, insurance, and electric. That’s a pretty good chunk of my pension which I’m a couple years away from. Our mortgage was very little. Moved to a smaller but still nice place where the assessment went from 350k to almost 600k in a couple years. Insurance essentially doubled to almost 5k a year as well. Constantly beating us down for more money yet not receiving any more service or value from it. |

|

|

|

|

I get that property taxes are necessary to fund city and county work but since the Dems have gotten into power the rate at which taxes have been going up is an absolute crime.

You work hard all your life. You struggle, scrimp and save to build a place in the sun and then the corrupt government comes for it. Just like everything else. Don't steal. The .gov hates competition. |

|

|

I have no idea what the hell I am doing. My last words will probably be, "Well hell ... that didn't work."

|

|

To those who have gone before us. May we earn what they have given.

"We didn't even get the good communism with gulags and death squads. We got the gay communism with trannys and women's basketball." - Agilt |

|

Mans right, the government calls everybody greedy for not paying.....but the truth is the government is the greedest entity in the world.

Sadly the local, state, and federal government could careless if he becomes homeless. One more slave they can control through welfare. |

|

|

|

|

Welcome to Washington. Many of our neighbors near Seattle couldn't afford to live in the houses they owned.

I guess you get what you vote for. |

|

|

I know I'll never go home.

So set fire to your ships, and past regrets, and be free. |

|

I am growing to Hate taxes in general but property tax even more. So if you take money you were taxed on when you earned it and spend it to improve your property it's now worth more and the gvt taxed you even more so you can have the pleasure of living there. AND if you don't pay tax on property you have paid for with money that has already been taxed the gvt will now take your property without compensating you AT All for the money you have spent to make it more valuable so they charged you more for it to keep. Shit is all wrong. Never mind the fact I homeschool my children so I get to pay property tax for schools I don't use and also get to buy curriculum out of pocket.

|

|

|

|

|

Property taxes tied to assessed home value are bullshit. I'm lucky mine are low as they have more than doubled for me in the last few years too due to all the real estate ass fuckery after being really stable for almost 20 years. I can't imagine living in some of those places with insane property tax values.

|

|

|

|

|

Originally Posted By Pardt: I am growing to Hate taxes in general but property tax even more. So if you take money you were taxed on when you earned it and spend it to improve your property it's now worth more and the gvt taxed you even more so you can have the pleasure of living there. AND if you don't pay tax on property you have paid for with money that has already been taxed the gvt will now take your property without compensating you AT All for the money you have spent to make it more valuable so they charged you more for it to keep. Shit is all wrong. Never mind the fact I homeschool my children so I get to pay property tax for schools I don't use and also get to buy curriculum out of pocket. View Quote |

|

|

|

|

Other states are getting hosed so hard on property taxes it's insane, this is one of the reasons why California still remains appealing to some. Prop 13 limits property taxes and still makes it livable here.

https://en.wikipedia.org/wiki/1978_California_Proposition_13 |

|

|

|

|

Look at the bright side. Our tax dollars have never been used more efficiently than they are now.

The roads are perfect, the crime is nonexistent, the education system is unparalleled. As long as we agree to give them more taxes, our lives can only improve. Win win! |

|

|

|

|

Move to a free state that you can afford?

|

|

|

|

|

Nobody move, nobody get hurt...I don't discriminate, I hate everyone equally... Me, myself and I - that's all I got in the end...Graduate from "Petty" University.

|

AR15.COM is the world's largest firearm community and is a gathering place for firearm enthusiasts of all types.

From hunters and military members, to competition shooters and general firearm enthusiasts, we welcome anyone who values and respects the way of the firearm.

Subscribe to our monthly Newsletter to receive firearm news, product discounts from your favorite Industry Partners, and more.

Copyright © 1996-2024 AR15.COM LLC. All Rights Reserved.

Any use of this content without express written consent is prohibited.

AR15.Com reserves the right to overwrite or replace any affiliate, commercial, or monetizable links, posted by users, with our own.